EB-5 Real Estate Investments 2025: Analyzing High-Success Opportunity Zones

EB-5 Real Estate Investments 2025: Analyzing High-Success Opportunity Zones

Blog Article

To obtain the EB-5 visa, you're required to invest at least $800,000 in an approved TEA or $1,050,000 elsewhere, making sure your funds establishes or sustains at least 10 full-time U.S. jobs. This route presents you and your loved ones an opportunity for permanent residency, but handling the intricate regulations, job creation guidelines, and documentation demands is challenging. Experienced EB-5 attorneys can optimize your plan, secure your investment, and address legal hurdles—here's how you can maximize success along the way.

Essential Insights

Understanding the EB-5 Visa Program: History and Objectives

As the U.S. government has continuously explored methods to enhance the national economy, Congress established the EB-5 Immigrant Investor Program in 1990 as a strategic measure to directly stimulate the American economy through overseas funding and workforce expansion. The program's history reveals its evolution from an entrepreneur's copyright an investor's visa, designed to attract overseas funding into commercial enterprises.

In 1992, Congress enhanced the program's investment origins by creating the Immigrant Investor Pilot Program (also known as) the Regional Center Program, which enabled investors to include both direct and indirect jobs toward the required 10-job creation threshold. This change made the program more attractive by enabling passive investments through pre-approved regional centers, significantly increasing participation rates after 2005 when USCIS implemented reforms to improve the application process.

TEA and Standard Investment Requirements Compared

The EB-5 visa program has transformed from its early beginnings to feature multiple investment levels designed for various economic areas. When investing, you should be familiar with the two capital deployment options at your disposal.

The basic investment threshold currently stands at $1,050,000 for ventures outside specified zones. However, if you invest in a designated TEA zone—comprising rural areas or locations with high unemployment—you'll benefit from a decreased requirement of $800,000.

Irrespective of which investment threshold is relevant for your situation, you need to ensure your capital establishes at least 10 full-time positions for qualifying U.S. workers. These differentiated investment requirements reflect the program's objective to stimulate economic growth in areas that need it most while giving investors a way to permanent residency.

Job Creation Requirements: Meeting the 10-Job Threshold

As an EB-5 investor, you're required to establish or maintain at least 10 full-time jobs for eligible U.S. workers within two years of obtaining a Conditional copyright. While direct investments necessitate you to create employer-employee relationships with your enterprise as the direct employer, regional center investments offer greater flexibility by allowing up to 90% of your job creation requirement to be satisfied through indirect jobs generated as a result of your investment. If you're considering supporting a troubled business, you can meet requirements through job maintenance rather than new job creation, as long as you sustain existing employment at pre-investment levels for a minimum of two years.

Direct versus Indirect Jobs

Meeting the job creation prerequisite forms the core of a successful EB-5 copyright, with different routes available depending on your investment structure. When you choose a direct investment, you must demonstrate direct job creation—your business must employ at least 10 full-time U.S. workers directly, forming an employer-employee relationship within your new commercial enterprise. Conversely, if you invest through a regional center, the rules allow you to count both direct and indirect job impact. Indirect jobs are those generated as a result of the project’s economic activity, such as jobs at suppliers or service providers, expanding your options for meeting the 10-job threshold with increased flexibility.

Regional Center Advantages

Opting for a regional center creates an efficient way to satisfy the EB-5 program's 10-job requirement, offering versatility that's particularly valuable for investors who desire a hands-off approach. This investment route allows you to consider various forms of job creation, substantially expanding your capacity to meet USCIS requirements.

One of the main benefits of the regional center approach is the minimal day-to-day management. You won't need to handle day-to-day business operations, enabling you to continue your existing job while working towards your copyright.

Numerous regional center projects are situated in targeted employment areas (TEAs), making you eligible for the lower $800,000 investment threshold rather than the standard $1.1 million requirement. Furthermore, exemplar approvals offer added assurance—when you place your investment in a pre-approved project, much of your I-526 petition is previously verified, necessitating only your source of funds documentation for review.

Work Maintenance Alternatives

Although numerous investors focus on establishing ten jobs, maintaining those positions throughout the required investment period is equally important for EB-5 compliance. If you're investing in a troubled business, you must show that existing jobs haven't been lost—this is where job retention strategies become essential. Following employee standing, keeping qualified U.S. staff, and ensuring positions remain full-time are all vital measures. Employment verification should be systematic and carefully documented to show that jobs were maintained during the investment window. Active deployment of a job buffer—establishing more than the minimum ten jobs—can provide a safeguard against unforeseen losses, lowering risk and reinforcing your application for meeting EB-5 requirements.

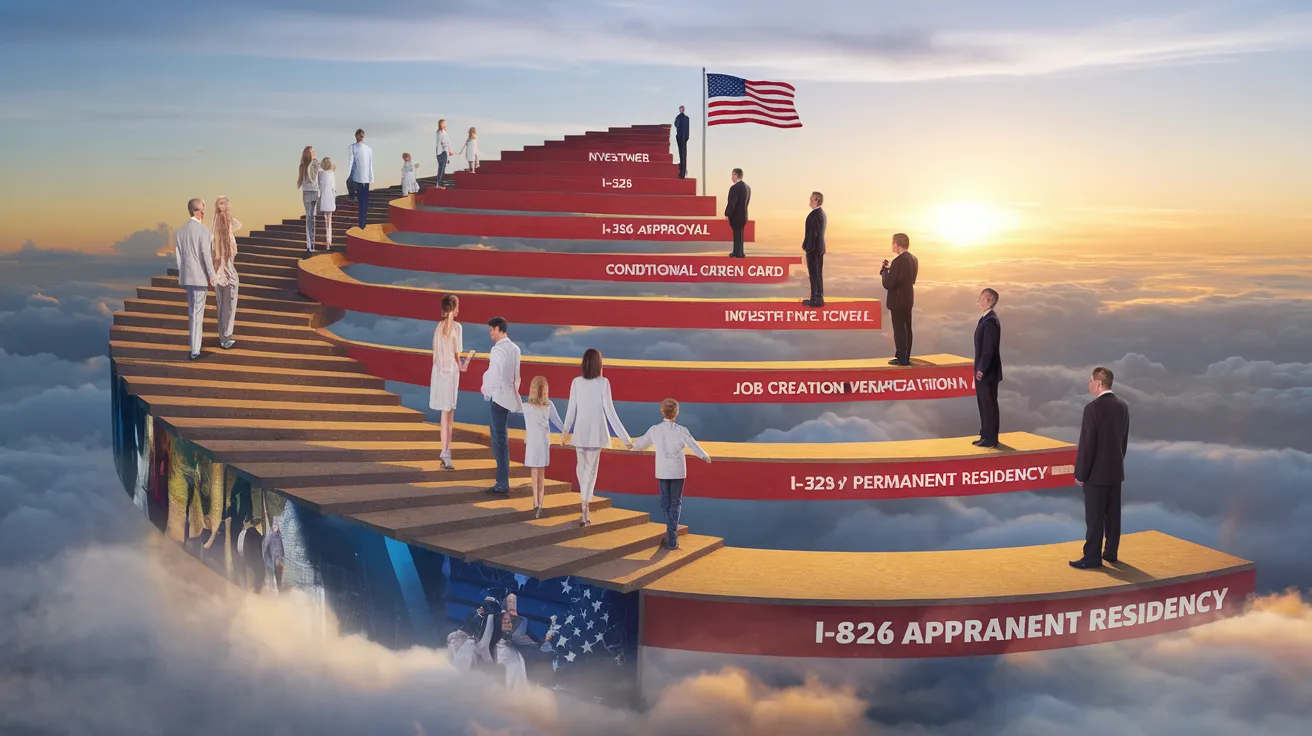

Understanding the Application Process: From I-526 Petition to Conditional copyright

Your path to EB-5 commences with filing Form I-526, which typically needs between 71.1 months to process, although rural projects can receive expedited approvals in as little as 11 months. Next, you'll advance through either adjustment of status (if you're in the U.S.) requiring 6-8 months, or consular processing (if outside the U.S.) necessitating DS-260 filing with an interview usually scheduled within 60-90 days after USCIS approval. Lastly, you will need to file Form I-829 to eliminate the conditions on your copyright status, a process that can take 22-48.5 months but eventually enables you and your family to permanently reside in the United States.

Filing Steps for I-526 Petition

The journey commences when you fill out and file Form I-526, the Alien Investor Immigration Petition, with U.S. Citizenship and Immigration Services (USCIS). Your petition has to demonstrate eligibility and prove your considerable investment in a qualifying U.S. business.

When preparing your I-526 checklist, compile documentation demonstrating your capital source, business planning documentation, and job creation projections. Decide between direct investment or regional eb5 green card center participation aligned with your investment objectives.

Present petition processing timelines vary significantly, with USCIS primarily processing applications filed before March 15, 2022. After receiving approval, you will need to proceed with submitting Form DS-260 for registration of your immigrant visa.

The petition serves as your formal request showcasing adherence to EB-5 criteria and investment commitment. While processing can be lengthy, thorough preparation ensures your petition satisfies all criteria for moving forward towards permanent residency.

Consular Processing vs. Adjustment of Status

Following the approval of your I-526 petition, you'll have to decide between two separate options to secure your EB-5 conditional copyright: adjustment of status or consular processing. Your current location and immigration status upon receiving approval will determine your ideal route.

Consular processing is required for individuals outside America, which involves filing the DS-260 application and civil documents to the National Visa Center, after which you must complete a mandatory interview at a United States consular office.

Adjustment of status is only available when you maintain legal status in the U.S. Although this route generally provides a faster timeline and allows you to work and travel during processing with work permits and travel documents, not everyone is eligible for this route.

All paths ultimately leads permanent residency but differs greatly in processing requirements and time frames.

Eliminating Residency Requirements

Once your petition is approved and you have gone through consular processing or status adjustment, you will be granted a conditional copyright lasting two years. To lift the conditions on your permanent residency, you need to file Form I-829 within the 90-day period before your card expires. You must to show you've met all residency requirements: maintained your investment and guaranteed your business created or is expected to create at least 10 full-time jobs. Fulfilling these conditions is crucial. Not filing your I-829 petition by the deadline could cause the termination of your copyright status. On-time, accurate filing, supported by robust documentation, is crucial for eliminating conditions and maintaining long-term residency benefits.

Transitioning from Conditional to copyright

As your two-year conditional copyright status approaches expiration, based on your EB-5 investment, you'll need to go through the essential process of removing these conditions to secure your copyright card.

As a conditional status investor, your primary duty is submitting Form I-829 (Entrepreneur's Petition for Condition Removal) in the 90-day timeframe leading up to the second anniversary of being granted your conditional copyright. This petition must demonstrate that you've maintained your investment throughout the required period and that your enterprise has established, or will create within a reasonable timeframe, at least 10 full-time employment opportunities for qualifying employees.

Your legal counsel will compile documentation verifying these requirements. Frequent obstacles include maintaining proper investment documentation and handling accounting concerns that might show your capital balance below the minimum required amount.

Critical Challenges in the EB-5 Investment Journey

The EB-5 investment journey involves various crucial hurdles that investors must navigate carefully to reach their goals. Processing slowdowns frequently occur, caused by visa backlogs and extended review periods, which can impact your immigration timeline. Investment challenges persist; not performing thorough due diligence on projects may jeopardize your capital and visa eligibility. Documentation complications, specifically concerning source of funds, frequently result in requests for evidence or denials if not thoroughly assembled. Regional center selection calls for thorough evaluation—choosing poorly creates compliance challenges and financial transparency concerns. Moreover, economic fluctuations can impact job creation requirements, while shifting immigration policies may alter program expectations and eligibility. Prepare for these challenges to protect your EB-5 investment and immigration success.

The Critical Role of Legal Expertise in EB-5 Success

Legal expertise influences your EB-5 journey at every stage, preventing critical missteps that might cause significant setbacks or rejections. Attorneys provide invaluable support throughout the visa process, from explaining funding prerequisites and employment generation requirements to ensuring compliance with USCIS regulations.

Your legal counsel will guide you through due diligence when assessing potential investment projects, through either direct investments or Regional Centers. They'll help you navigate the complexities of visa adjudication and address any legal challenges that arise during your application.

Although not mandatory, professional legal counsel is vital for positive results. A qualified EB-5 legal expert partners with regional centers, government officials, and project developers to establish a comprehensive legal strategy. Considering the major financial and personal commitment involved, expert legal direction from knowledgeable professionals increases your probability of obtaining copyright status.

Frequently Asked Questions

Are Family Members Allowed to Process Visa Applications in Various Countries

If family members live in different countries, they can arrange separate visa interview locations. Typically, applicants interview at the U.S. Embassy or Consulate closest to where they live. Contact the U.S. Embassy or Consulate directly to coordinate interviews in different locations. This flexibility helps families who are spread across multiple countries during the immigration process.

Is Business Experience or English Proficiency Required for Investors?

Concerned about if you require business experience or English fluency for your EB-5 visa? You'll be pleased to learn you don't need requirements for business background, education, or language ability when applying for an EB-5 investor visa. Processing time won't increase because of limited business experience. You simply need to fulfill the investment requirements and show you'll be involved in business management.

Do I Have to Live in the Same Area as My EB-5 Investment Project?

You are not required to live where your EB-5 project is located. The EB-5 visa program doesn't impose any residency requirements connecting you to your project location. Once your I-526E petition is approved and you receive your conditional copyright, you have the freedom to settle anywhere in the United States. Your investment needs to stay at risk for no less than 24 months, but your place of residence isn't confined to the project's location.

What Protections Exist for Your Capital Under Escrow Protection?

Your escrow-held investment funds are protected in several ways. Escrow accounts function as a protective financial buffer, specifically for substantial EB-5 investments. You'll gain FDIC insurance through Insured Cash Sweep (ICS), which fully protects your $800,000 investment instead of just $250,000 without ICS. The escrow arrangement guarantees your funds will be available when your I-526 petition is granted or reimbursed if rejected, offering investment protection through this contractual arrangement with a independent escrow administrator.

Is International Travel Possible After Receiving My copyright?

Once you have your copyright in hand, international travel becomes possible. As a copyright holder, you may travel internationally, but these travels must be for limited periods. For trips less than 12 months, no special permits are needed. However, if you anticipate being away for more than 12 months, you should request a reentry permit (Form I-131) before your trip. Stays abroad exceeding 180 days might impact your immigration standing.

Wrapping Up

Steering the EB-5 process goes beyond mere statistics—it's a path where each element is crucial. You'll must satisfy specific investment requirements, verify lawful funding, and guarantee job creation, all while moving through a complicated application procedure. View an experienced EB-5 attorney as your compass: they do more than direct, they help anticipate challenges, transforming complex requirements into achievable steps on your road to permanent residency. Your copyright ambition requires precision; don't travel alone.

Report this page